Hope Fund-Lend - Digital Loan Platform

Hope Fund-Lend operates as a digital platform facilitating loan services provided by RBI-licensed NBFC partners. All financial transactions and credit decisions are exclusively managed by the NBFC in compliance with RBI guidelines.

Loan Features & Compliance:

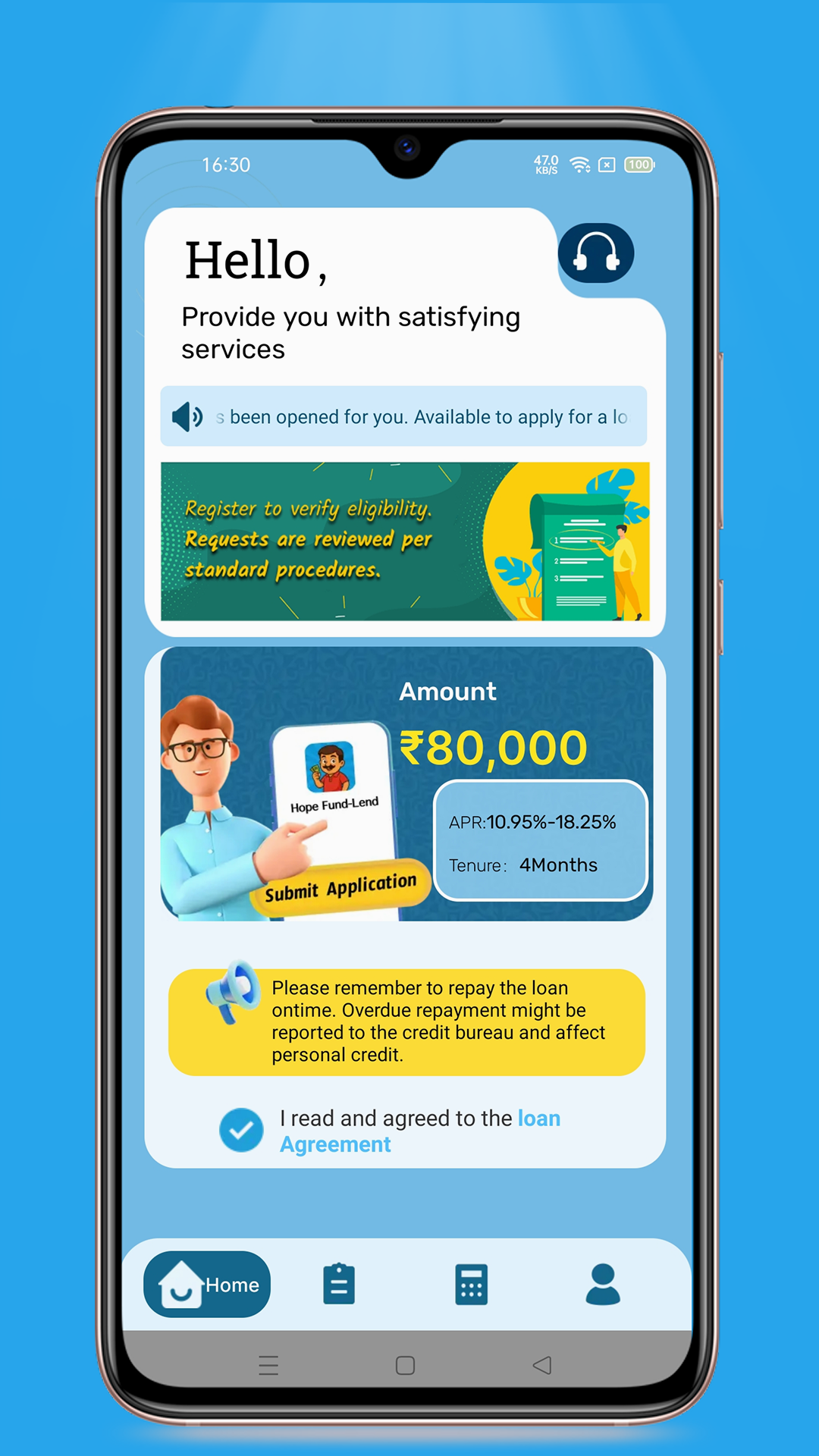

1. Loan Amount: ₹5,000 - ₹80,000

2. Tenure: 3-12 months

3. Standard Interest Rate: 0.03%-0.05% daily (APR 10.95%-18.25%)

*Actual terms determined post credit evaluation. Maximum APR capped at 18.25% as per RBI guidelines.

Example Calculation (Illustrative):

Principal: ₹50,000 | Tenure: 4 months (120 days)

Interest: ₹3,000 = 120 × 0.05% × ₹50,000

Total Repayable: ₹53,000

Eligibility & Documentation:

- Indian resident aged 18+ years

- PAN Card

- Aadhaar Card

- Basic creditworthiness check

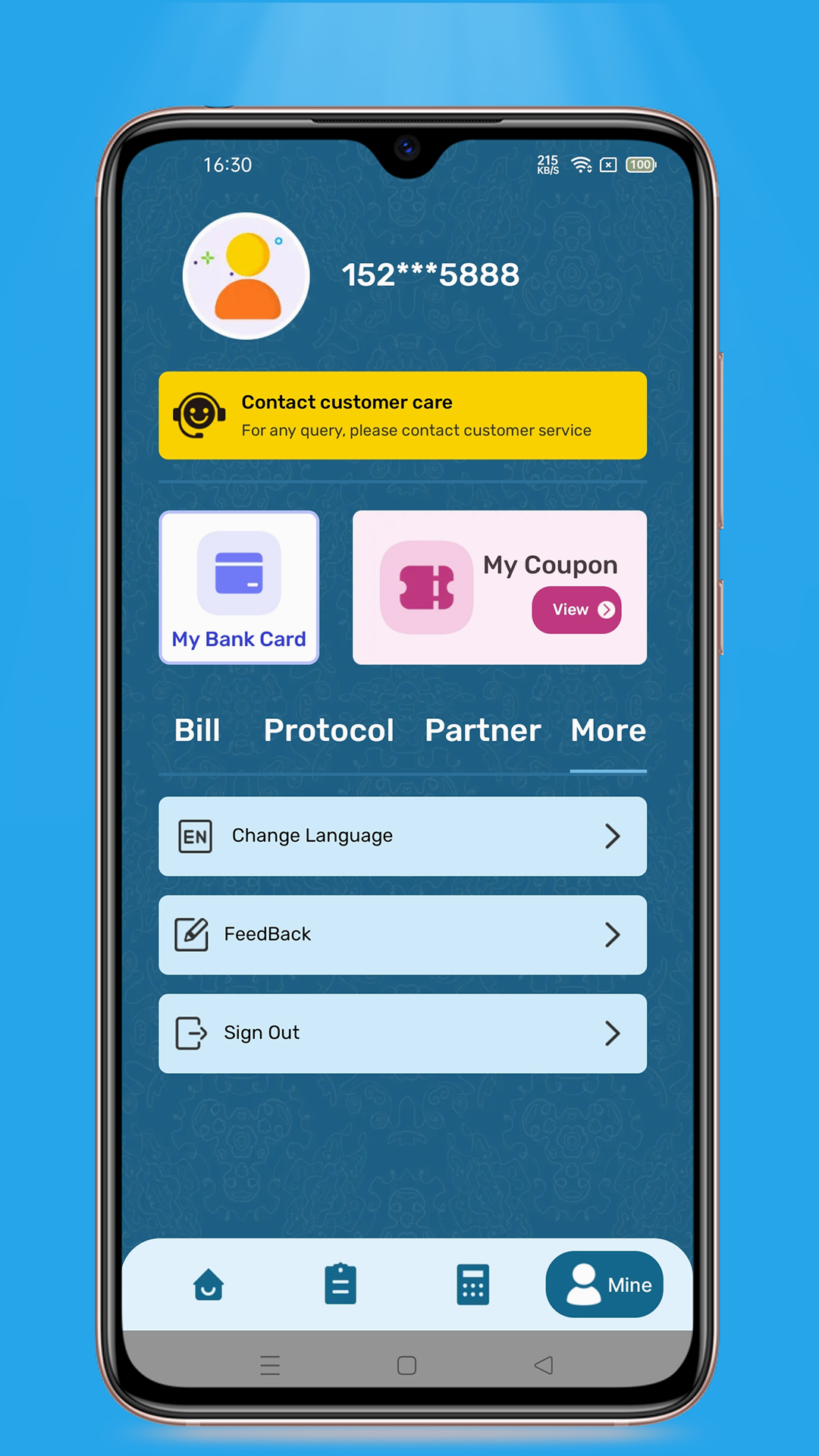

Data Security Assurance:

- Aadhaar/PAN verification through NPCI-approved channels

- Data encrypted as per RBI's Digital Lending Guidelines

- Privacy Policy: https://www.cashforgoldpvt.com/pact.html

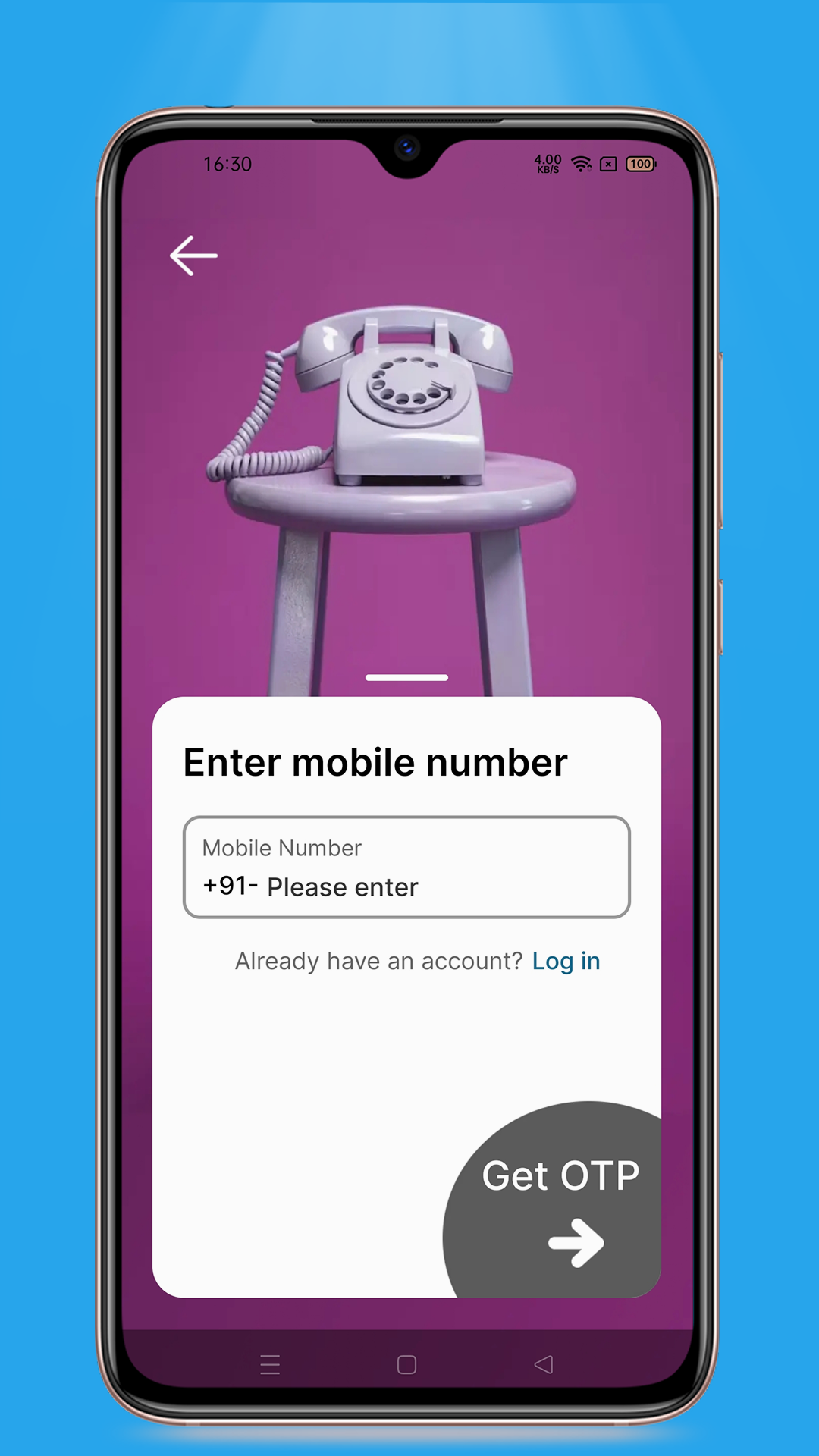

How It Works:

1. Download & register with KYC documents

2. Submit loan request through platform

3. Receive preliminary eligibility indication*

4. Complete NBFC's verification process

5. Final approval & disbursement to registered bank account